Dynamic Tax Calculator - Billing Address

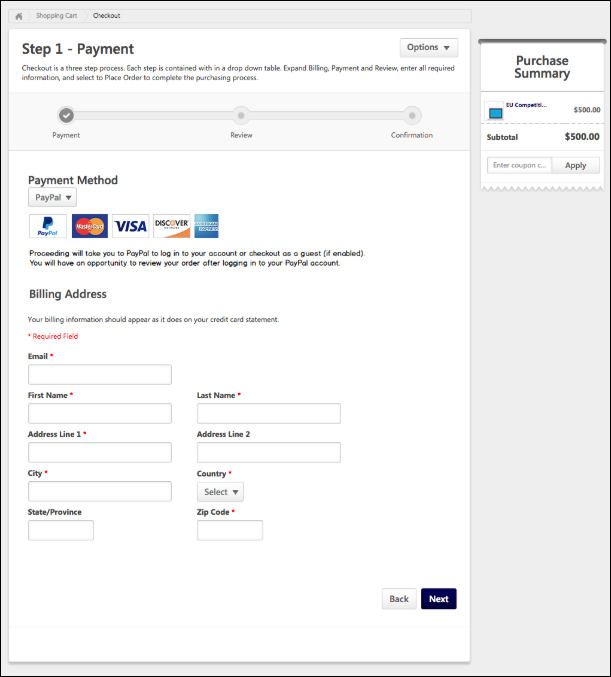

In order to dynamically calculate taxes during the checkout process, a billing address must be collected from the user. If the Cybersource Tax Calculator integration has been enabled and the user has selected PayPal as the payment method, the user is prompted to populate the following billing address fields during the first step of the checkout process when purchasing training:

This information allows Cybersource to dynamically calculate tax for the purchase.

- If enabled in User Payment Preferences, users can also opt to provide a secondary address if their billing address is separate from their shipping address. Providing a secondary address can be configured as required via User Payment Preferences, if needed. If preferences are set to collect a secondary address, the user will see the following options during checkout:

- Use the billing address as my shipping address?

- No - If the user selects this option, the user's billing address will be the same as their shipping address.

- Yes - If the user selects this option, the user will be prompted to complete the following fields for the secondary address:

-

- First Name

- Last Name

- Address Line 1

- Address Line 2

- City

- Country

- State/Province

- Zip Code

For more information about the checkout process: See Checkout - Step 1 - Payment.