This page is only available when accessed via the Manage Transactions page.

On the Order History Details page for the transaction, the administrator is able to initiate refunds and adjust prices. Note: Refunds are not available if the item was purchased entirely by the user's cost center.

All price adjustments and refunds are tracked in the Price Adjustment History section.

See Refunds Overview for the business rules related to refunds and processing fees.

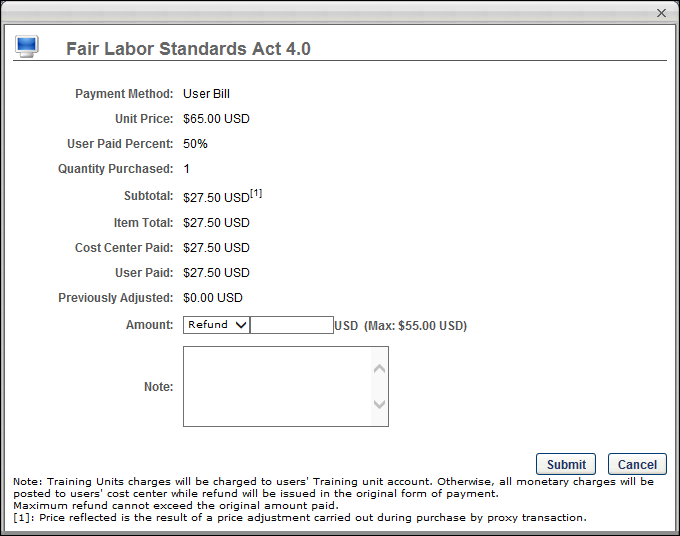

To add a refund or adjust the price for an item, in the Options column, click the Add Refund icon ![]() . This opens the price adjustment pop-up for that item.

. This opens the price adjustment pop-up for that item.

Order Details

The details of the order display above the Amount field. The details list the payment method, unit price, etc.

If a price override was included in the transaction, then the adjustment is represented by a superscript [1] to the right of the unit price. The adjustment details display at the bottom of the pop-up to indicate that the unit price was adjusted during a purchase by proxy transaction.

The maximum available refund for the user reflects the actual price the user paid for the training item, not the unit price of the training prior to the price adjustment.

Note: The Discount field displays cart-level price adjustments, such as coupon discounts. This field does not reflect unit price adjustments for purchase by proxy transactions.

Amount

From the Amount drop-down list, select whether you are issuing a refund or adding an additional charge to the transaction.

In the field, enter the amount that is being refunded or charged. Note: The currency displayed is always the currency in which it was purchased.

If a user withdraws from a session that has a withdrawal penalty, the penalty amount is a percentage of the final amount paid by the user or a currency amount.

Considerations

- If the transaction was paid for by credit card AND cost center, any price adjustment will be charged to the user's cost center. This can be verified by using the Billing - Enterprise standard report.

- In the case that there is an issue when refunding to a credit card, the user's cost center will be refunded.

Estimated Tax/Estimated Refund Total

For portals with sales tax functionality enabled, Estimated Tax and Estimated Refund Total fields display below the Amount field.

- The Estimated Tax field is only visible and active when the Refund option is selected in the Amount field. This field displays the estimate of the refunded tax. The amount is an estimate since the actual amount calculated may vary slightly from the estimate. The estimate calculates dynamically when an amount is entered in the Amount field. Note: If the line item price is adjusted to a higher amount, tax is not charged for the additional amount.

- The Estimated Refund Total field is only visible and active when the Refund option is selected in the Amount field. This field displays the total refund amount, which includes the estimate of the refunded tax.

Note: The amount in the Max field does not include the tax charged to the user at the time of transaction. This field only displays the maximum amount available for the refund based on the unit price minus discounts and transaction fees.

Note

In the Note field, you may enter any notes regarding the adjustment.

Submit

Click the button to submit the refund.

Note: For portals with an integration with CCH, once the button is clicked to submit the refund, CCH calculates the actual tax. If the connection to the CCH integration fails at the time the refund is submitted, then no tax amount is refunded. The failure to refund tax is logged in the record.

Adjustments

Any adjustments that are done display in the Price Adjustment History section for the order.

Use Cases

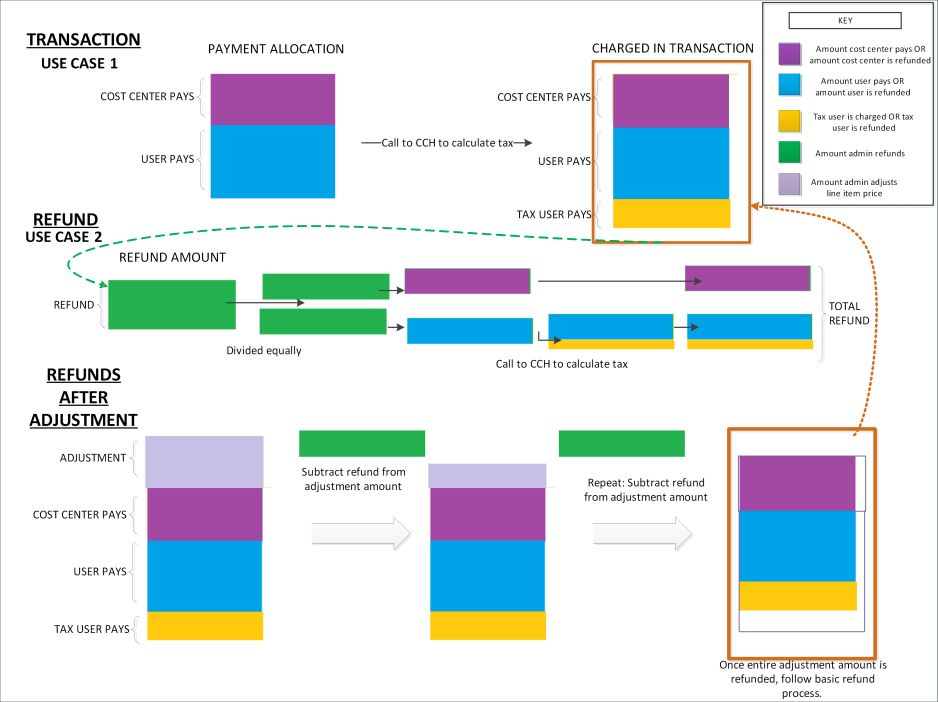

The following use cases apply to refunds for which tax was calculated. Portals must have the sales tax functionality enabled in order to calculate tax.

Use Case 1

A user purchases a curriculum with a credit card. For the user’s Division organizational unit (OU), the Cost Center pays 40% of the purchase price and the user pays 60%.

For the refund, the following applies to the tax calculation:

- Tax is calculated on the amount the user pays.

- Tax is not calculated on the amount the Cost Center pays.

- If a coupon is used, the coupon amount is deducted from the amount the user pays and tax is calculated after the deduction.

- After the tax is calculated, the processing fee charged for using a credit card is added to the purchase amount.

Use Case 2

An administrator refunds a user $15.00 on a line item from the manage transactions page. In the original purchase, the user purchased a curriculum with a credit card. For the user’s Division OU, the cost center paid 40% and the user paid the remaining 60%.

For the refund, the following applies to the tax calculation:

- The $15.00 refunded by the administrator is divided equally between the user and the cost center; $7.50 goes to each payment source.

- Tax is calculated on the $7.50 refunded to the user.

- The user’s total refund amount is $7.50 plus the applicable tax.

- The rules above apply for both full and partial refunds.

Use Case 3

A user purchases a curriculum with a credit card. For the user’s Division OU, the cost center pays 40% and the user pays 60%. After the user has completed the transaction, the administrator increases the line item amount by $10.00 from the Manage Transactions page. After the price adjustment, the administrator gives the user a full refund from the Manage Transactions page.

For a full refund after a price adjustment, the following applies to the tax calculation:

- The system first refunds the adjusted amount of $10.00.

- No tax was charged for the adjustment; therefore, no tax is calculated when refunding the adjustment to the cost center.

- Once the full amount of the adjustment is refunded, the remaining amount for the line item is refunded.

- The amount refunded by the administrator is divided equally between the user and the Cost Center; half goes to each payment source.

- The tax is calculated on the amount that is refunded to the user.

- The user’s total refund amount is half of the refunded amount plus the applicable tax.

Use Case 4

A user purchases a curriculum with a credit card. For the user’s Division OU, the cost center pays 40% and the user pays 60%. After the user has completed the transaction, the administrator increases the line item amount by $10.00 from the Manage Transactions page. After the price adjustment, the administrator gives the user a refund of $5.00.

For a partial refund after a price adjustment, the following applies to the tax calculation:

- The system first refunds the adjusted amount of $5.00.

- No tax was charged for the adjustment; therefore, no tax is calculated when refunding the adjustment to the cost center.

Use Cases Workflow