The Sales Tax Report displays the tax breakdown of each item or transaction that has been taxed upon purchase using the LMS and EXE functionality.

This functionality is available with the Advanced eCommerce functionality. To utilize the Sales Tax Report, you must use your own merchant account. To enable the Sales Tax Report for your portal, contact Global Customer Support.

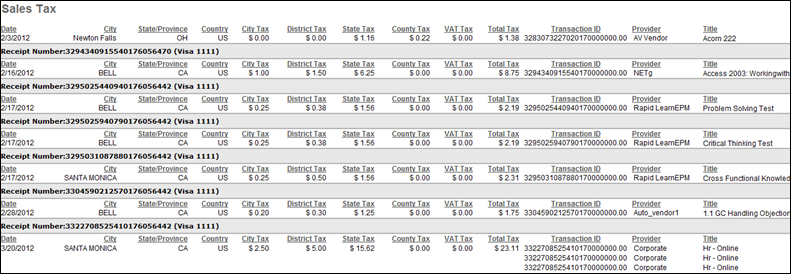

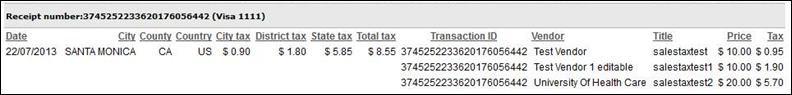

The Sales Tax Report displays the appropriate taxes that are applied for each item within a transaction. If multiple tax values are applied for different items within a transaction, then each tax value is displayed.

| PERMISSION NAME | PERMISSION DESCRIPTION | CATEGORY |

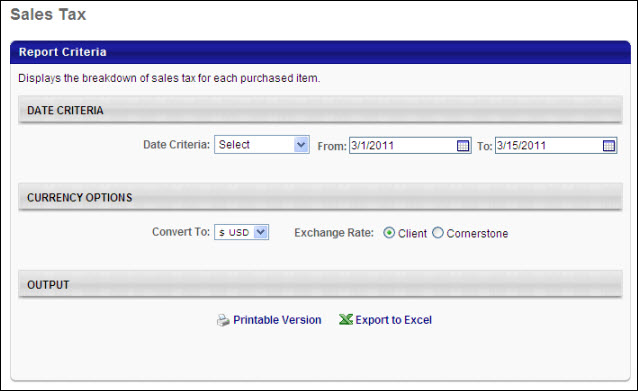

Criteria

| Filter Name | Description |

|---|---|

| Date Criteria | Filter your results by date. If any part of a transaction falls within that time frame, the transaction displays. Note: Date Criteria is always implemented using UTC (Coordinated Universal Time). |

| Convert To | Select to which of the available currencies to convert all transactions. You may also choose to use the exchange rate that is set by Client or Cornerstone. |

Output

Only items that were taxed at the time of the transaction are included in this report.

- If the item was not taxed in past transactions, but is now set to be taxed, it does not appear in this report.

- Items that are no longer taxed, but were previously taxed in the past do appear in this report.

The City Tax, District Tax, State Tax, and Country/VAT Tax columns only appear if the report contains an item in which the tax is applied.