Applicant Experience - TCC Work Opportunity Tax Credit Assessment

TCC Work Opportunity Tax Credit (WOTC) assessments can be added to the application workflow or assigned via Manage Candidates or Manage Applicants.

| PERMISSION NAME | PERMISSION DESCRIPTION | CATEGORY |

| Applicant Status Bank - Manage | Grants ability to access and manage Applicant Status Bank. | Recruiting Administration |

| Application Workflow Template - View | Grants ability to access and view Application Workflow Templates. | Recruiting Administration |

| EMAIL NAME | EMAIL DESCRIPTION | ACTION TYPE |

| Assign Integration Assessment |

This email is triggered when an Edge integration assessment is assigned to an applicant, such as a WOTC assessment. This email can be configured as a notification or a reminder, and it can be sent to External Applicant, Internal Applicant, OU Approver, Hiring Manager, OU Approver, or a specific user. This email only triggers when a successful response is received from the vendor. Note: The APPLICANT.INTEGRATION.ASSESSMENT.LINK tag must be included in the email. This tag provides a link that the applicant can click to access the assessment. Note about Auto-Assignment of Pre-Employment Verifications: This email also applies to auto-assignment of pre-employment verifications, via the Automated Candidate Progression (Early Adopter) functionality. For more information, see Feature Activation Preferences. |

Recruiting |

Application Workflow

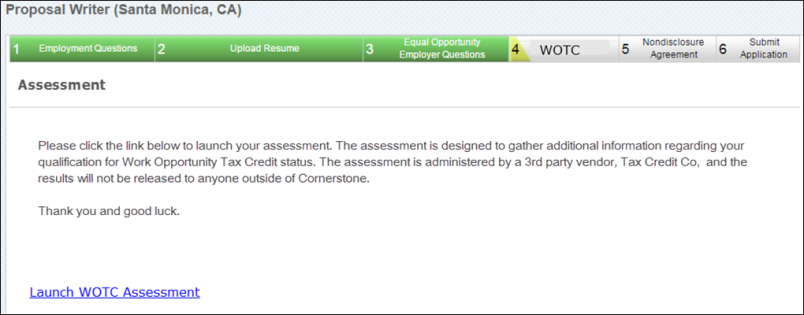

When a Work Opportunity Tax Credit assessment is included in the Standard application workflow, then applicants can complete the assessment when filling out the application. The assessment appears as a step in the workflow. The name of the step is dependent on how the step is named when configuring the requisition.

The assessment can also be added to the workflow for Mobile-Friendly applications by adding the assessment as an action item on the workflow.

Assign on Manage Applicants

Work Opportunity Tax Credit assessments can be assigned via the Manage Applicants page. To assign an assessment:

- Navigate to the Manage Applicants page, and select the applicants to whom the Work Opportunity Tax Credit integration assessment should be assigned.

- Ensure that the applicant is in the proper Work Opportunity Tax Credit Integration status by selecting the Actions drop-down menu, selecting the Change status to action, selecting the Work Opportunity Tax Credit Integration Assessment status, and select .

- While the appropriate applicants are still selected, select the Actions drop-down menu, and select the Assign Integration Assessment action.

- Select the Work Opportunity Tax Credit Assessment from the drop-down menu, and select .

- The applicants will receive the Assign Integration Assessment email with a link that directs them to the Work Opportunity Tax Credit qualifying screening tool. Once complete, the results are available on the Application tab within the Applicant Profile. Note: This email is only triggered if it is configured in Email Administration.