Adjustment Guidelines Administration - Overview

These guidelines can be created as specific amounts, can implement a recommendation matrix or custom formula, and can be discretionary or non-discretionary. Adjustment guidelines can be created by Organizational Unit (OU).

The Adjustment Guidelines functionality allows the administrator to define and maintain compensation recommendations and guidelines for both salaried and hourly employees. The administrator can set up adjustment guidelines in order to provide recommended compensation for base, bonus, and equity compensation.

An adjustment guideline can be created for any component including base types (merit increase, market adjustment, COLA, promotion, custom base types), bonus, RSA, ISO, or NQO and each recommendation can be tied to performance metrics in order to drive pay for performance. The administrator can define availability of the guideline to setup different recommendations and guidelines for different areas of the organization.

If a user is subject to multiple adjustment guidelines, the guideline with the highest payout is applied.

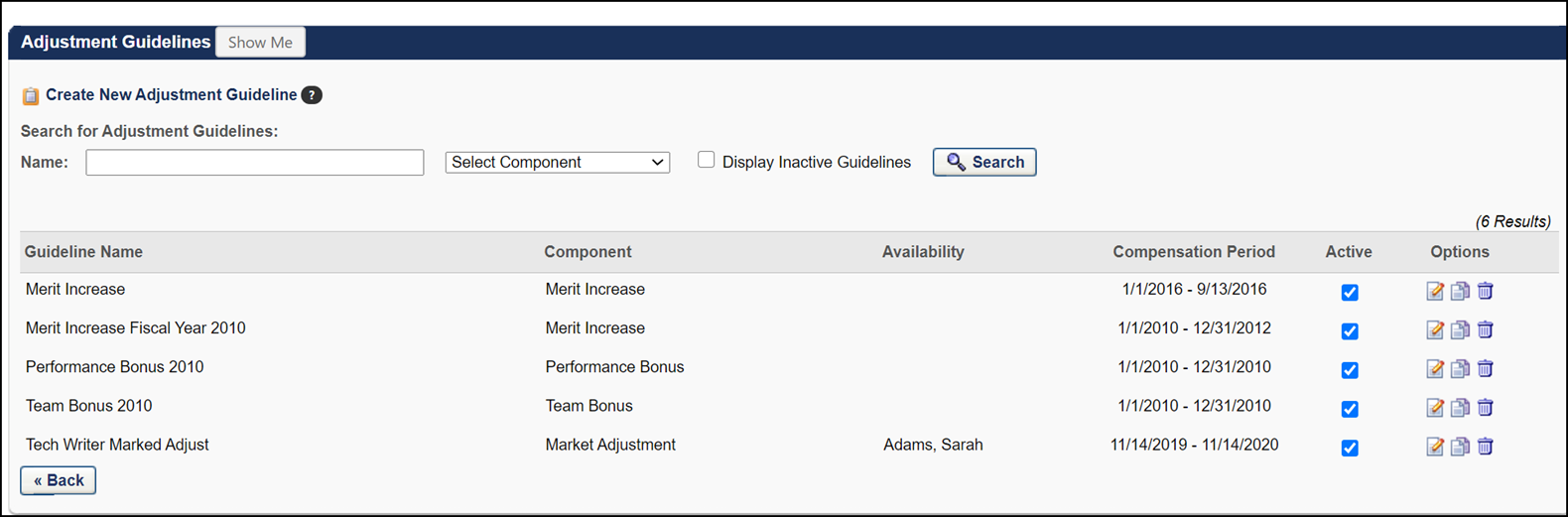

Administrators can create new adjustment guidelines, edit existing guidelines, and activate guidelines.

There are three compensation types to which you can apply adjustment guidelines:

- Base - Includes merit increase, marked adjustment, cost of living, promotion, and custom base types. See Adjustment Guidelines - Create Base Types.

- Bonus - Includes one-time cash awards or you can create custom bonus types. See Adjustment Guidelines - Create Bonus Types.

- Equity - A grant of company stock which is restricted to an employee until the shares vest. See Adjustment Guidelines - Create Equity Types.

To manage Adjustment Guidelines, go to .

| PERMISSION NAME | PERMISSION DESCRIPTION | CATEGORY |

Adjustment Guidelines Workflow

If more than one guideline applies to an employee for a specific component, the following workflow applies:

- If the guideline is a recommendation matrix, then the midpoint of the recommended range will apply for the employee.

- If more than one guideline with recommendation matrices applies, then the guideline with the highest midpoint will apply for the employee.

- If more than one guideline with recommendation matrices applies, and the midpoints are equal between the guidelines, then the guideline with the highest maximum will apply for the employee.

- If one guideline is a specific amount and another guideline is a recommendation matrix, then the system will compare the specific amount against the midpoint of the recommended range of the guideline and apply the highest value for the employee.

Proration and Calculations

Proration can be defined based on an employee's time in an OU or their Hire Date. If the proration is based on the Last Hire Date, then the most recent guideline that applies to the employee is used to display recommendations for the component on the task. If the proration is based on the time the employee was in an OU, and the employee switched managers during the compensation period, then the employee appears in both the previous manager's and current manager's compensation task as follows:

- On the previous manager's task, the budget is adjusted accordingly to support the employee's adjustments.

- The guideline that pulls in for the previous manager is the guideline that is available to the employee based on the employee's previous OU.

- The adjustment amounts from this guideline are prorated based on the employee's time in the previous OU during the compensation period.

- The minimum, maximum, and median recommendations are prorated based on this percentage.

- On the current manager's task, the budget is adjusted accordingly to support the employee's compensation adjustments.

- The guideline that pulls in for the current manager is the most recent guideline that is available to the employee based on the employee's current OU.

- The adjustment amounts from this guideline are prorated based on the employee's time in the current OU during the compensation period.

- The minimum, maximum, and median recommendations are prorated based on this percentage.

- For Bonus and Equity components with targets, the targets are also prorated.

If the previous manager does not have a compensation task assigned with the same proration criteria, then the employee does not appear in the last manager's task as the following applies:

- The employee only appears under the current manager's task with prorated recommendations.

- The employee does not receive an adjustment for their time under the previous manager and OU.

If the same guideline applies to the employee in their prior and current OU, then the same adjustment guideline is used for the previous and current managers. The summation of the adjustments from the last and current managers appears to the employee on their compensation statement and all compensation reporting.

If LTI Awards that contain splits (i.e., RSA, ISO) are used and are prorated, then the complete LTI Award Target and recommended award are prorated in the workflow described in this section, and the following applies:

- For each manager, the splits are calculated based on the manager's prorated LTI Award recommendation and the guideline that applies to the employee based on the employee's time in OU.

- The prorated split amounts are aggregated from all managers involved in compensating the employee for the task.

- The aggregated split amounts are captured in the system and converted to their grant/option amounts when the equity grant's effective date is reached.